It is such a weird Friday for me because today, October 3, 2025, there was no unemployment data from the Bureau of Labor Statistics. My trading brain feels like there’s a black hole or something. 🙂

This is due to the current government shutdown that’s been in place since Wednesday. And it’s not the first time we’ve seen this. The last one was back in 2018–2019 during the first Trump administration, and it lasted about 30 days. That one was over the Mexico border enforcement.

Now, there could be a whole debate about what this current shutdown is really about, but I don’t want to go there. I want to keep the focus on what will actually help you as a trader.

How Much Does the Shutdown Really Matter?

In my humble opinion, the shutdown only matters directly if you’re employed by a government agency that’s furloughed or delayed. If that’s the case, I’m wishing the best for you and hoping it resolves soon — because that’s your livelihood.

For most of us private citizens, though, who don’t have direct government involvement, the shutdown doesn’t affect daily life all that much. We’re still able to travel, to get and send mail, and so on.

And as for Wall Street? Over the past few days, it’s pretty much shrugged this off. There have been pauses here and there, but overall the market’s been grinding higher.

Why? Because of the bigger picture — and one of the biggest components of that is earnings.

Why I’m Focusing on Earnings

With the boom in AI investment — and the way it’s fueling revenue growth for large companies, including titans like Nvidia — I suspect this earnings season is going to show, in the numbers, substantial growth. And that growth is fueling the economic strength of the U.S.

And as I’ve always said: the S&P 500 is the leading indicator of the U.S. economy. So, long story short, overall things are pointing up.

Does that mean we won’t see some seasonal weakness in October? Of course not. That may happen. And I’ll stay on top of it in my day-to-day research I put out on ES futures in the S&P Edge Pro.

But right now, I want to help you get prepared for earnings season.

Trying Something New: Timely Earnings Updates

This quarter, I’m going to try something new. What I’m doing is putting more of a stock trader hat on — alongside my futures trader hat that I always wear.

Keep in mind: whether I’m providing analysis on stocks, futures, or anything else, the techniques I teach work across any market and any timeframe. I might sprinkle in some forex or crypto here and there, but only if the charts really look interesting.

And that’s because, after surveying our Trading Tribe this year, I know most of you are trading stocks and options on stocks.

So, while my research service S&P Edge Pro doesn’t directly cover those, I want to show you how you can apply what you’re learning from my courses — and from the trading plans you’re building through the First 40 Trading Club and Elevate — to real-time market action.

And we’re gonna do this by me sharing timely pre-earnings blog posts. I’ll publish a day or two prior to the info release so you have time to review. I’ll share where price action, momentum, and forecasting are coming into play. And of course I’ll include a chart.

Where I’m Starting: S&P 500 Components

Since I’m an E-mini S&P 500 futures trader, I’m starting with the stocks in the S&P 500.

The S&P 500 is put together by S&P Global. You can piece the earnings information together from various sites, but it takes some digging. Here are some examples I got from ChatGPT when I was exploring this option:

- https://strike.market/earnings-calendar/sp-500

- https://marketchameleon.com/Calendar/Earnings

- https://www.investing.com/earnings-calendar

- https://www.marketbeat.com/earnings/

- https://www.ii.co.uk/investing-with-ii/international-investing/us-earnings-season

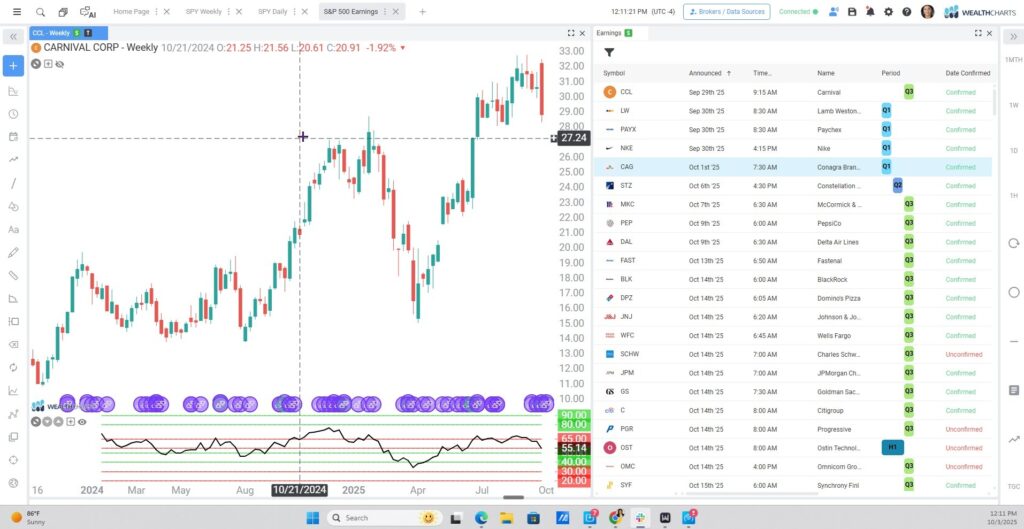

Now, here’s what I opted for instead. Because I’m on a serious mission to expand my charting software know-how— and because next week’s Wealth365 conference is putting a little fire under my bum — I actually made a full earnings watchlist in WealthCharts this morning.

And it turned out great!

My Earnings Preparation Steps

Let me break down what I did — and how you can do something similar:

Step 1: Determine your world of stocks.

Pick a focus. It could be:

- A specific watchlist

- The Nasdaq 100

- The Dow 30

- The S&P 500 (what I’m doing)

- Or even international stocks

It’s kind of impossible to follow thousands of companies reporting earnings. Just pick a lane to start. You can always change it up later.

Step 2: Build your earnings release watchlist.

You can do this manually from the websites I listed above. Or you can use a platform like Wealthcharts to make the process easier.

An ideal earnings watchlist would include:

- The company/stock ticker symbol

- The expected earnings date

- The time of day of the release (before market open, after close, etc.)

- Whether the date of the release is confirmed (since these can change)

Step 3: Sort chronologically

I filtered via the Announcement column to bring the tickers into an order corresponding to how soon that company is reporting (sooner versus later). Here’s a screenshot of how that looks on my Wealthcharts screen:

How I’ll Be Using This Earnings Watchlist

When I see a chart that looks interesting leading into an earnings release — at least a day prior — I’ll share a free report here on the blog covering that stock.

That way you can see how what you’re learning in my courses, and applying through your trading plans, connects directly to today’s market action.

The charts I share will all be from WealthCharts. Partly because I want to keep practicing in the platform, and partly because the Wealth365 Summit is giving me a good push to keep learning.

FYI: WealthCharts has a really cool feature: an all-day Zoom room during business hours where you can hop in and ask questions. I used it today, and it was amazing. They provide excellent support.

Wrapping Up

Building a watch list is just the first step so that you’re better prepared when earnings season unfolds.

Generally, it kicks off with banks reporting, and rounds out with the big tech names. But it’s always fluid, so it’s important to stay aware.

I’ll be sharing my free blog posts on various companies as we go, and I’ll be talking about this more in my Wealth365 presentation on Wednesday, October 8 at 12:00PM ET.

Look forward to digging into this earnings season with you then!

~Hima

Leave a Reply